ev tax credit 2022 status

The renewal of an EV tax credit for Tesla provides new opportunities for growth 2. Language calls for a 2000 credit for used EVs.

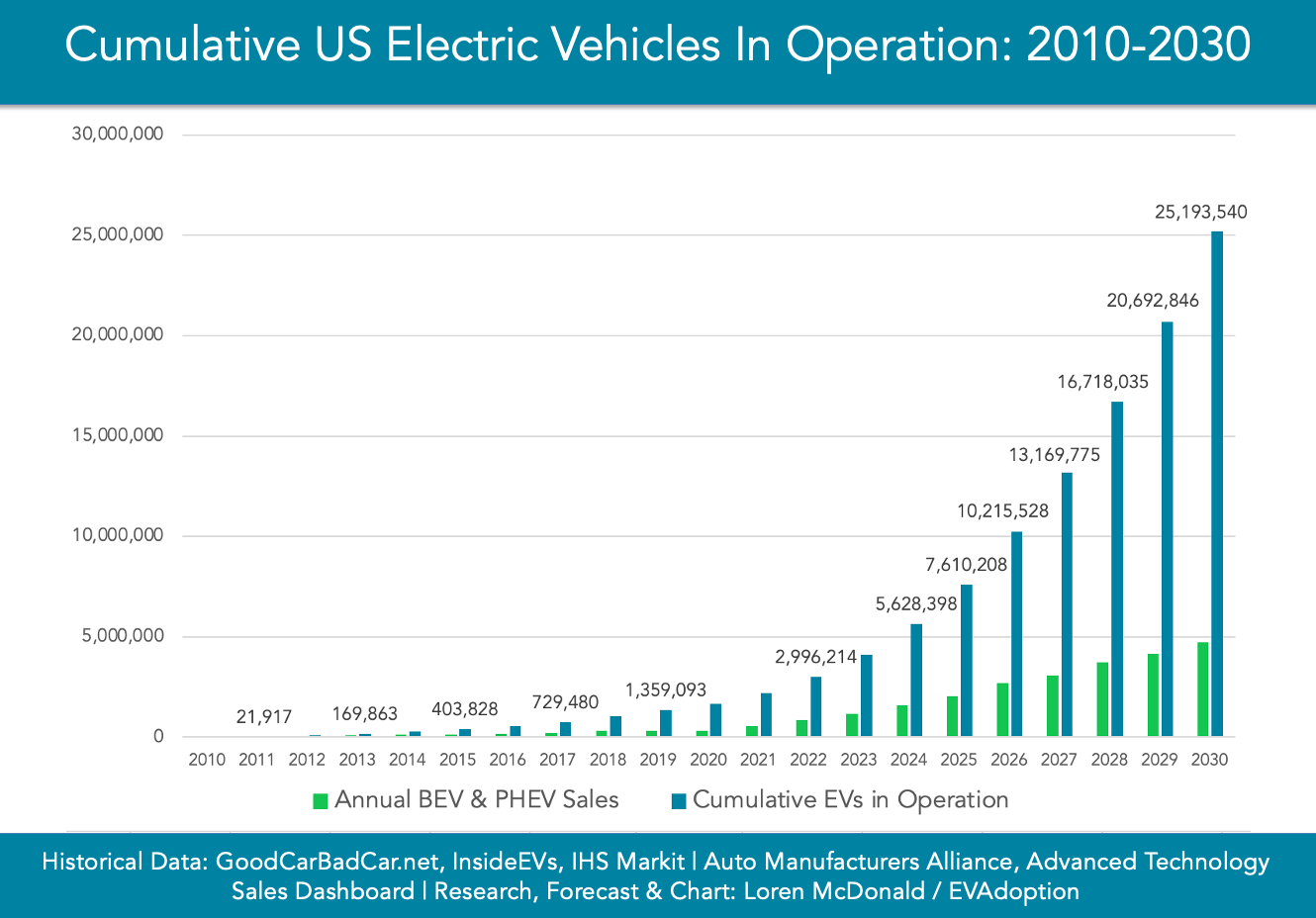

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

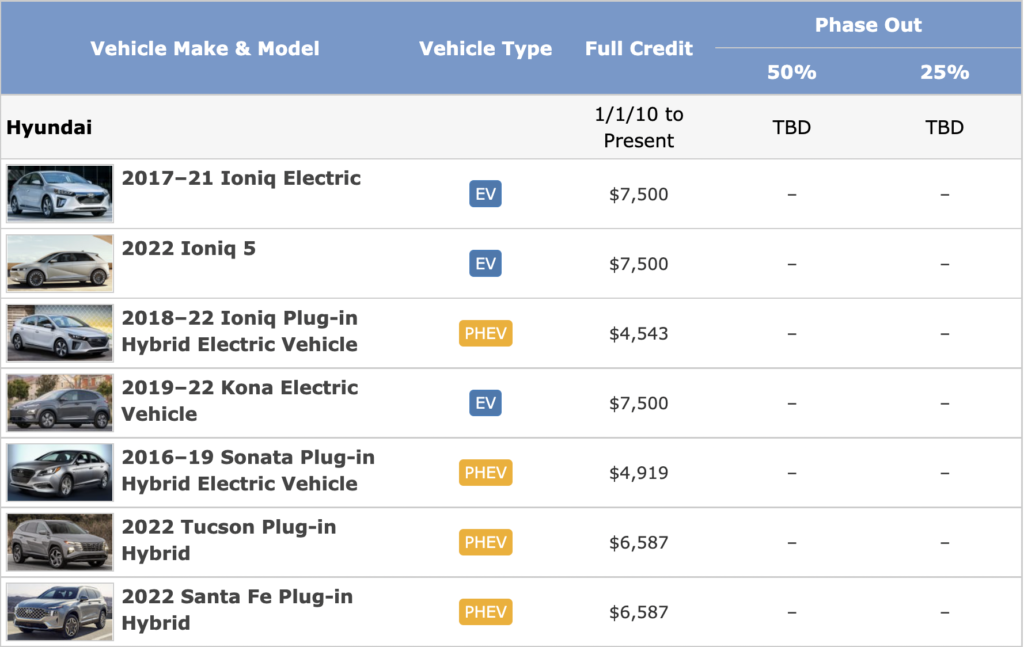

For example if you owed 5000 in federal taxes and received a 7500 federal tax credit for buying an electric car your taxes would be reduced to 0.

. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. Toyota is on the verge of running out of federal tax credits in the US as the Japanese company has sold more than 190000 plug-in. There is a federal tax credit of up to 7500 available for most electric cars in 2022.

Well talk about what a point is how it operates and more in this blog. Jan 05 2022 at 829pm ET. The exceptions are Tesla and General Motors whose tax credits have been phased out.

Several months later it seems that revisions to the credit are returning to lawmaker agendas. But the following year only electric vehicles made in the US. Ev Tax Credit 2022 Status.

The effective date for this is after December 31 2021. The US Federal tax credit is up to 7500 for an buying. Like leasing an EV buying a used electric auto also does not allow you to claim the traditional EV tax credit.

26 2022 As more electric vehicles reach dealer showrooms EV tax credits are stuck in a legislative limbo according to observers on Capitol Hill. The Build Back Better bill will increase the current electric car tax credit from 7500 to. However according to the US.

New EV Federal Tax Credit Update. The State of Texas offers a 2500 rebate for buying an electric car. A refundable tax credit is not a point of purchase rebate.

In 2022 taxpayers may be eligible for a federal tax credit of up to 7500 for electric vehicles. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal. Still you would not receive.

76 rows Status of the 12500 federal tax credit for EVs. Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000. Department of Energy EVs purchased new after 2010 could be eligible for the federal EV tax credit if less than 400000 models have been sold.

What truly stands out in this approved bill is the 75 billion promised to. C40 Recharge Pure Electric. The credit amount will vary based on the capacity of the battery used to power the vehicle.

The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. We are currently updating sales estimates through. EVAdoption will update our Federal EV tax credit phase-out tracker a few times per year so check back on a regular basis.

The amount of the credit will vary depending on the capacity of the. Texas EV Rebate Program 2000 applications accepted per year. Updated April 2022.

There is a federal tax credit of up to 7500 available for most electric cars in 2022. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. When the aforementioned 12 trillion.

But that could change. Latest on Tesla EV Tax Credit March 2022 The Clean Energy Act for America would have a positive impact on Tesla by making most Tesla cars eligible for an 8000 House. Congress is mulling over passing the build back better act which would.

The Build Back Better bill would give EV buyers a 7500 tax credit through 2026 to charge up sales. Sales of electric vehicles. Under current IRS code consumers who buy a qualified plug-in electric drive motor vehicle may qualify for a federal tax credit worth up to 7500 depending on battery capacity.

The second document made further changes. What Is the New Federal EV Tax Credit for 2022.

Ev Incentives Ev Savings Calculator Pg E

Toyota S Ev Tax Credit Cap Is Expected To Be Reached Soon Bloomberg

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Sweden Plugin Ev Share 52 In February Kia Niro Leads Cleantechnica

Overview Electric Vehicles Tax Benefits Purchase Incentives In The European Union 2021 Acea European Automobile Manufacturers Association

Federal Tax Credits Will Soon Be Phased Out For Toyota Ev Customers In The Us Electrek

These 5 Plugin Vehicle Models Would Benefit Most From Proposed Us Ev Tax Credit Update Chart Cleantechnica

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

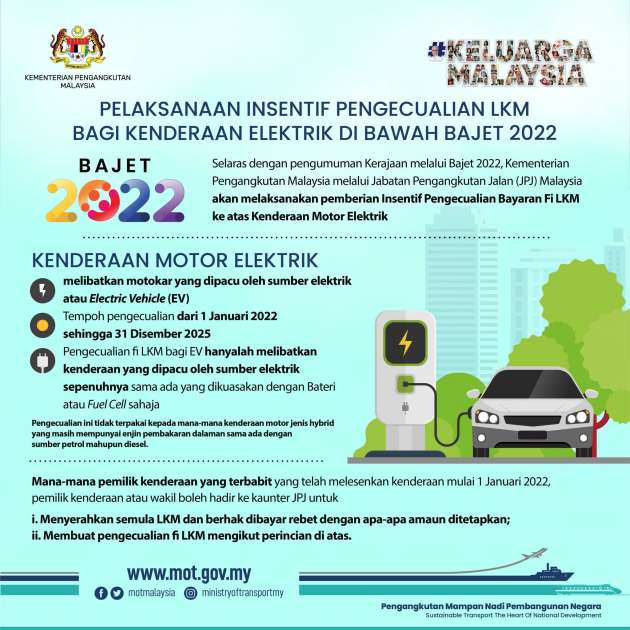

Evs Officially Exempted From Road Tax Until 2025 Oku Also Get Rebate For Modified National Ckd Vehicles Paultan Org

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Norway S Stunning New Ev Numbers 84 Of New Car Sales In January All Electric

Which Vehicles Qualify For An Ev Tax Credit In 2022 Getjerry Com

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Key Senator Questions Need For Expanding U S Ev Tax Credit Reuters

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek